Efficient Credit Card Processing

Merchant Services

AVP Solutions goes beyond credit payment processing. Offering tailored, secure solutions that reduce fees, enhance fraud prevention, and transform transactions into growth opportunities for your business.

- Merchant Accounts

- 35+ Years of Experience

- 24/7 Dedicated Support

- Fast & Secure Transactions

Payment Solutions

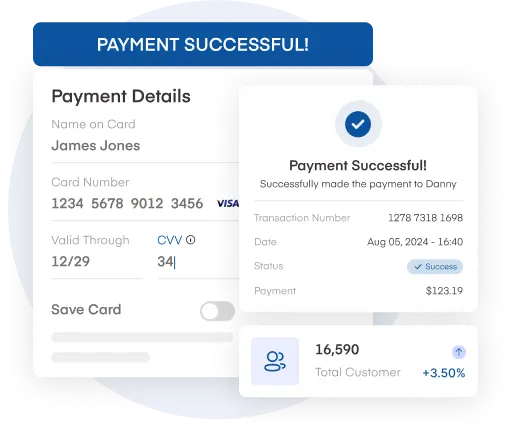

Payment solutions help businesses process payments through credit and debit cards, making it easier for customers to pay. They help businesses authenticate transactions and ensure merchants receive funds from all non-paper-based methods, such as those involving electronic wallets and mobile payments, among others.

Credit Card Processing Solutions

Point Of Sale Solutions

Credit & Debit Card Payment Processing

Online Payment Processing Services

We Are So Glad You Are Here

Offer Your Customers Multiple Payment Options

Virtual Payment Processing Solutions

Virtual payment processing allows consumers to pay for products or services electronically without physical contact. Credit and debit cards won’t be touching any terminal via swipe, dip, or tap to process payments.

In-Store Solutions

In a world that is fast becoming a contactless society and the rise in consumers using digital wallets, you must have the best retail POS (point of sale) system to accept transactions.

High-Risk Merchant Account and Services

Let’s look at what a high-risk merchant is, the advantages and disadvantages that high-risk merchant accounts offer, and if there’s anything we can do to save your business money with our credit card processing merchant services.

Partners

Join Our Newsletter

What user says about Payjo

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

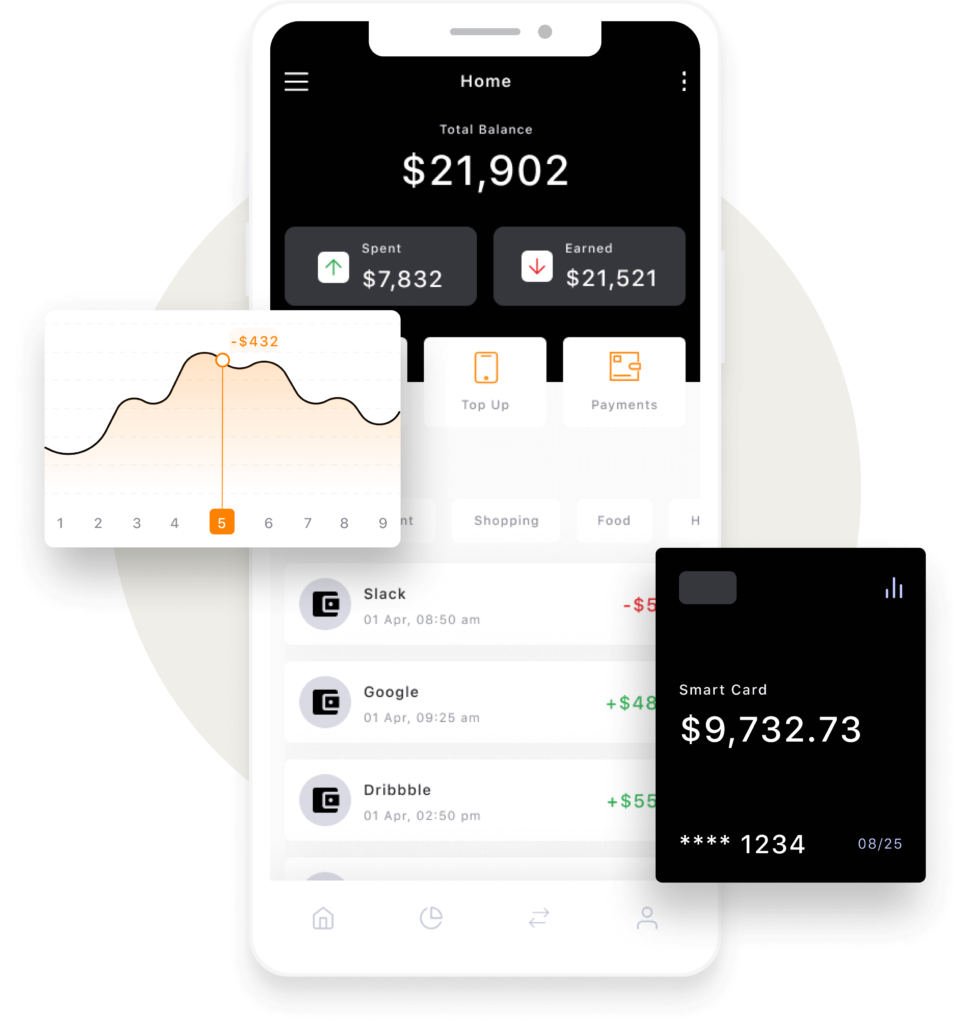

Benefit will you get, if you use Payjo

Withdraw Easily

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus.

Investment

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus.

Join Our Newsletter

What user says about Payjo

Benefit will you get, if you use Payjo

Withdraw Easily

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus.

Investment

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus.

Frequently Asked Questions

In terms of safety, ACH payments are generally considered to be a secure and reliable method of payment. This is because ACH payments are processed through secure payment processing solutions that use encryption and other security measures to protect sensitive information. If you're interested in learning more about the benefits of accepting ACH payments for your business, check out this informative blog post from AVPSolutions.com:Read More

Credit card processing merchant services is an integral part of payment processing solutions, allowing businesses to Accept Credit Card Payments quickly and easily. It enables the transfer of funds between the customer's account and the merchant's account in a secure and efficient manner. The process begins when a customer initiates a transaction by swiping, inserting, or tapping their credit card at a POS terminal or online payment system. The payment information is then captured and transmitted to the credit card processor, which verifies the information and requests authorization from the customer's bank. To learn more, visit importance of mobile credit card processing. Read More

Businesses that Accept Credit Card Payments through payment processing solutions such as POS and online payment systems can take steps to fight back against chargebacks. The first step is to gather all relevant documentation related to the disputed transaction, such as receipts, shipping information, and communication with the customer. This information can then be submitted as evidence to the payment processor to support the business's case. Learn more about the ways to reduce chargebacks: Read More

Merchant services refer to payment processing solutions that allow businesses to accept credit card payments from customers. These solutions can be in the form of traditional credit card processing at the point of sale (POS) or online payment systems. Merchant services companies provide businesses with the necessary tools and technology to process and manage transactions. These tools include credit card terminals, payment gateways, and virtual terminals. For more information on protecting merchant accounts, refer to the blog .Read More

Chargeback protection is a service offered by merchant services companies to help businesses prevent financial losses from chargebacks. To protect yourself from chargebacks, implement strong fraud prevention measures, have clear policies for handling disputes, and work with a merchant services provider who offers chargeback alerts and dispute resolution services. For more information, check out the blog post at .Read More