It’s a long, fascinating moment of transition in the world of payments — and for payments around the world. That changing landscape includes virtual wallets, growing P2P payments, and ways to make existing platforms more secure — as with the EMV standards coming to American payment cards this fall.

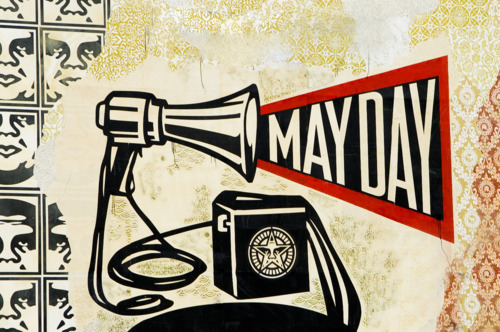

Old Hacks, New Payments