Customized Payment Processing Solutions

Chargeback Protection Program

In-Store and Online Payment Capabilities

24/7 Customer Support

Fast, Reliable Payment Processing

Scalable Solutions for Growing Businesses

Chargeback Prevention and Fraud Protection

What are Chargebacks?

Chargebacks, also known as reversals, are disputed transactions by consumers. Created as a form of consumer protection, chargebacks gives consumers a peace of mind from unauthorized or fraudulent transactions. When a complaint is made, the bank refunds the original amount to the consumer. Unless the merchant can prove that the transaction is legitimate, the merchant lose not only products or services that have already been sold, as well as payment and fees incurred for processing the transaction, but also money from chargeback penalties.

What causes Chargebacks?

Merchant Error

This can be caused from errors in merchant account set-up, confusing terms and conditions, transactions, and/or order processing.

- Unclear Terms and Conditions: Ensure your website, packaging, or product includes accurate descriptions, terms, and conditions, along with clear usage instructions and warning labels.

- Complicated Return Policies: Simplify your refund or return process to discourage customers from choosing chargebacks as an easier alternative. Refunds are typically less costly than losing a chargeback dispute.

- Unclear Disclosures: Avoid exaggerated claims and provide a clear, concise “Terms and Conditions” section to build trust with your customers and protect your business.

Criminal/ True Fraud

These chargebacks are caused by the client intending to steal, or be dishonest, and be deceitful with by the client. The clients keep your products or use your services and use the chargeback process to obtain a refund on the entire amount, essentially similar to shoplifting.

- Using Stolen Cards: Fraudsters often use stolen cards, so always require CVV and billing address details to verify transactions.

- Falsely Claiming Non-Delivery: Customers may claim they never received an item—counter this with tracking information and communication records.

- Abusing the Chargeback Process: Some clients use the chargeback system to keep products or services while receiving a refund, essentially committing digital shoplifting.

Friendly Fraud

Some clients have no ill-intentions regarding processing chargebacks. This can be caused from miscommunication, confusion about the product, and/or slip from memory.

- Confusing Credit Card Descriptor: Use a recognizable name on credit card statements to avoid confusion that can lead to chargebacks.

- Lack of Contact Information: Ensure clients can easily find contact details to resolve issues before resorting to chargebacks.

- Poor Communication: Quick responses and clear customer service prevent misunderstandings and unnecessary disputes.

How can Chargebacks affect my business?

Credit card issuing banks take chargebacks seriously. Having more than 1 percent of your charges reversed as chargebacks can get a business labeled as fraudulent. Not only can this damage your business’ image but can also result in loss of clients and revenue.

Chargebacks have both short and long-term effects on any merchant. When a chargeback is filed, clients get refunded and get to keep the goods while merchants lose revenue and potential profit. Merchants are also charged fees with every chargeback even if they are later cancelled.

Chargebacks also increase the cost of doing business from increased processing fee rates to terminated merchant accounts that could result in inability to process credit card payments up to five years. Having a chargeback protection program is a necessity, not a desire.

When do I need a Chargeback Program?

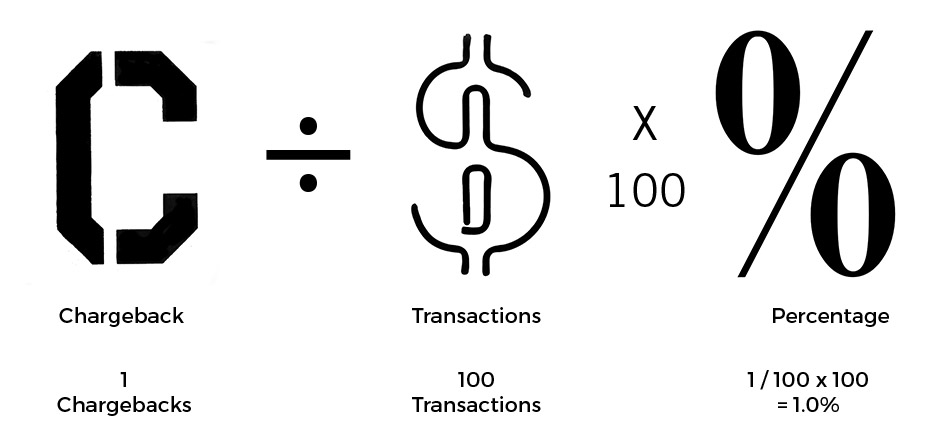

Chargeback ratio, also known as the chargeback-to-transaction ratio, can be calculated by dividing the number of chargebacks with the total number of transactions. Here’s how:

- Manage your chargebacks ratio before and after reaching the limit

- Outline personalized strategies to reduce risk and manage chargebacks

- Assist in fighting and disputing chargebacks, improving your chargeback ratio

- Protect your revenue and enhance profits

- Improve your business by highlighting weak points that lead to chargebacks

- Improve your customer service, one of the easiest ways to reduce chargebacks

- Detect and prevent fraud before it happens.

- Process with instant accurate approvals so you can focus on other areas

About us

World’s best solution

AVP Solutions specializes in high risk merchant account payment processing solutions, ensuring secure, reliable transactions even in complex markets. We offer expert support and custom solutions that allow your business to operate smoothly and mitigate payment challenges.