Understanding Swipe Fees: Insights from The Strawhecker Group

Introduction to The Strawhecker Group’s Swipe Fee Infographic

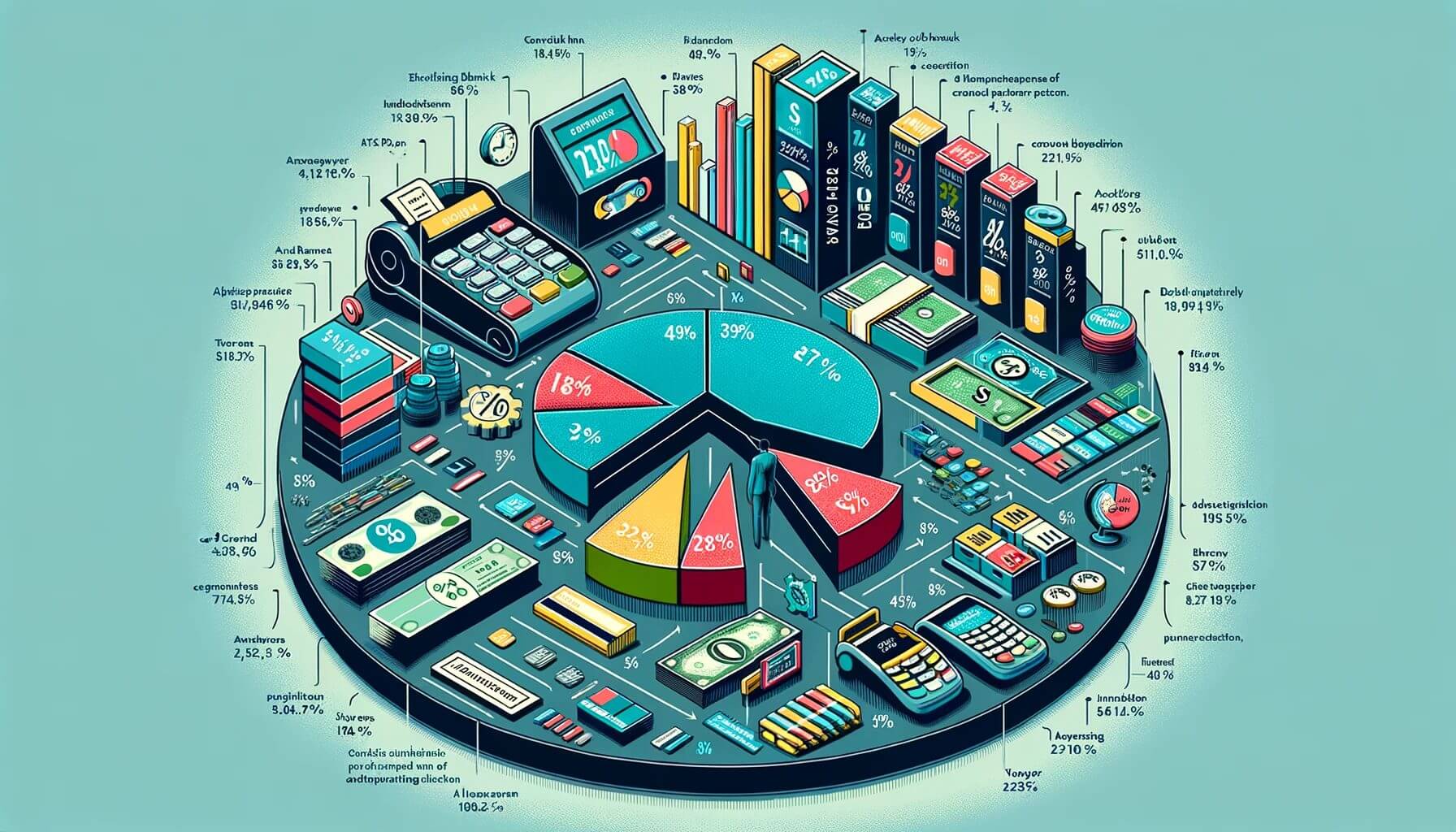

The Strawhecker Group is an advisory/consulting group for us in the Payments Industry. And they’ve recently come up with a compelling infographic explaining swipe fees — what they are, and where they go.

We’re including it here, for your perusal, enjoyment — and dare we say, edification!

What Constitutes a Typical Card Swipe Fee?

The typical card swipe fee is just north of 2%. Where does it all go? Well, as the chart reminds us, the biggest piece goes to the issuing bank (which, admittedly, is why banks like to issue them), who oversee payments, “branding,” and of course fraud detection, cover fraud losses, etc.

Distribution of Swipe Fees

A smaller piece goes to the acquirer, who handles the “paperwork” — virtual though it may be — for the merchant, including consumer disputes and risk management. Then you have the processor (!), who is busy shuttling that payment information where it needs to be, and more importantly, shuttling those funds where they need to be, too.

The Role of the Card Brand

And finally, the smallest bit goes to the card brand — those folks reminding you, through all their ads and sponsorships, to never leave home without it, or which card is the “official” card of which sport, championship, etc.

The Impact of Swipe Fees on the Payments Ecosystem

So in a sense — using a card takes a village! And certainly, using a card supports a village! A village full of financial institutions and their workers. So, thank you, swipers!

Merchant Strategies Regarding Swipe Fees

And given how “swipe fees” are in the financial news, we note that most merchants are not planning to pass along these fees, in order to stay competitive and keep luring customers, even though the law now allows it — in some states.

Credit Card Reform and Merchant Benefits

One recent article in Forbes said the legal limbering could be a good thing for merchants: “Merchants want more business not less. Credit card reform gives them more weapons in their competitive battle to boost sales and build loyalty. Many offer private label card credits — or store specific cards — and could use swipe fees to steer shoppers toward these products. “

How AVPS Can Assist

And as ever, if you want to explore new incentives, gift or prepaid card options, etc., for your customers, we at AVPS are ready to give you a hand. Once you’re done with the nifty linked graphic — give us a call!