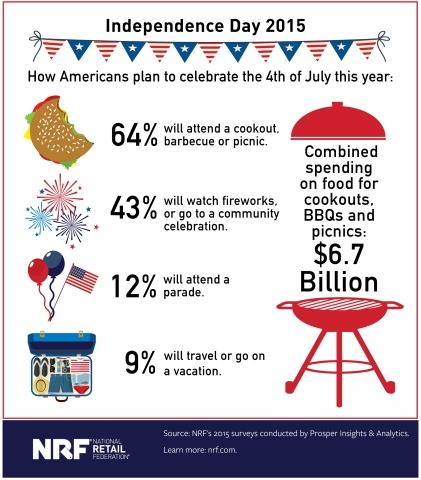

A pair of mid-summer surveys come our way, showing that Americans really like using the plastic in their wallets, but are still learning all the ins-and-outs of what it means to have both credit, and a credit score.

Trendlines and Survey Markers: Consumers Prefer Charge Cards, But Still Learning About Them