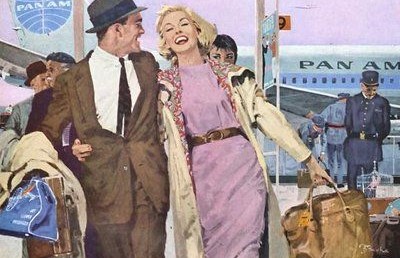

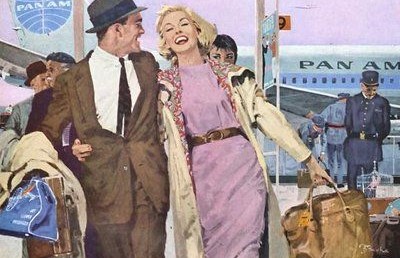

With Memorial Day, summer’s first “bookend” arrives, for a season that marks its midpoint with the 4th of July, and wraps up — practically speaking — with Labor Day.

Memorial Day — and Summer Travel Season — Arrive

With Memorial Day, summer’s first “bookend” arrives, for a season that marks its midpoint with the 4th of July, and wraps up — practically speaking — with Labor Day.

We write a lot about the coming changes to “charge cards” as we’ve known them, for a couple generations. Changes driven both by technology, and the vulnerabilities of that technology. For example, as a regular reader of these posts, you know that EMV cards are coming, with adaptation being pushed even faster by news of massive breaches at Target, Neiman-Marcus, and other retailers.

We certainly hope not. But the FBI isn’t so sure. A recent Washington Post article states that “nearly two dozen companies have been hacked in cases similar to the Target breach and more almost certainly will fall victim in the months ahead, the FBI recently warned retailers,” this “according to an official who was not authorized to speak publicly.”

In increasing signs of a perking — or at least, stabilizing — economy, comes the news that late payments on credit cards are at a 20-year low. According to an AP article, the credit reporting bureau TransUnion is reporting “ the second-lowest recorded since the second quarter of 1994, when the rate was 0.56 percent, and it’s running ahead of the historical average of 1.03 percent. The firm’s records go back to 1992.”

Once again, this week’s news cycle in the world of credit and finance gives us a fascinating glimpse into how varied the metrics are of credit card reporting, to the degree that two different studies can came out at the same time, each claiming different conclusions about how women use credit cards.

Merchant Credit Card Processing: Putting Credit Payment in Context “There are three types of lies: lies, damned lies, and worse…

The days of paying with cash everywhere you go are long gone. A newer technology age has replaced the traditional payment methods and made debit and credit payments the new business standard. All businesses benefit from having the ability to accept credit card payments. People do not carry cash anymore. Keeping track of spending is far more difficult when everything is paid for with cash. Banks statements and tools have made it easy for consumers to purchase all items with a card and manage their spending. Consumers spend more when they pay with plastic.