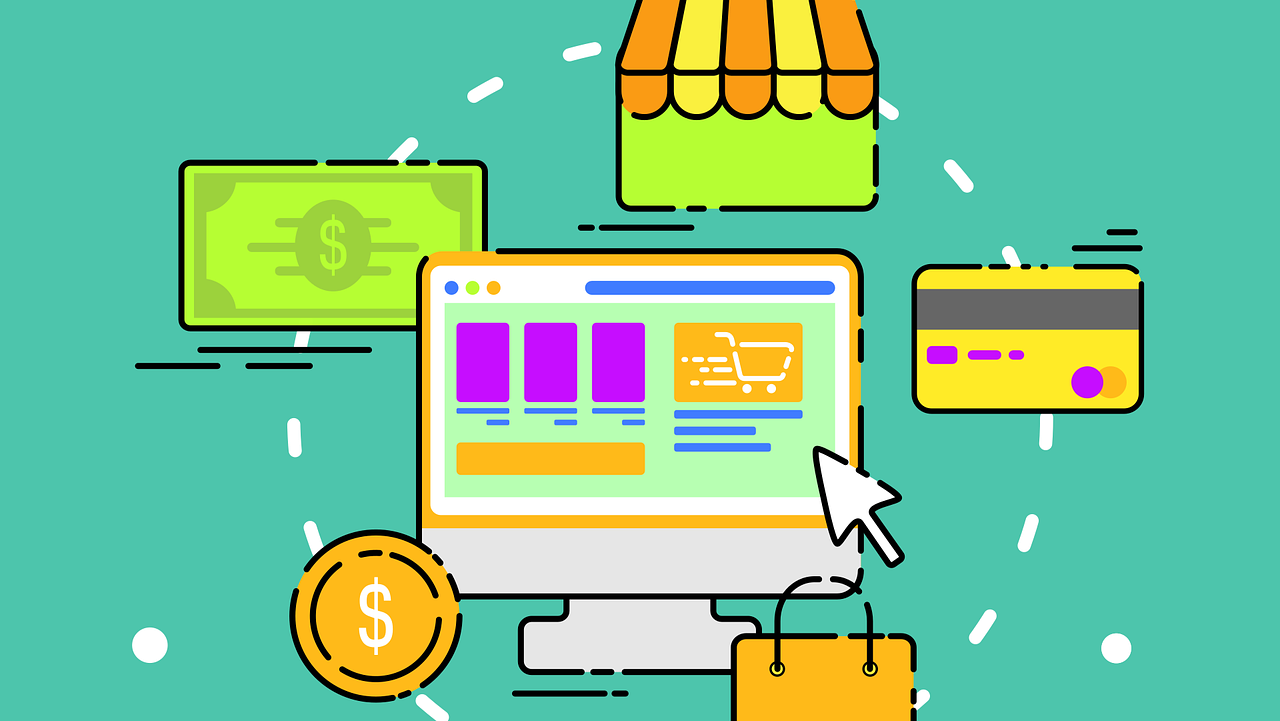

These days, many successful businesses have an online component. Even traditionally brick and mortar establishments are jumping into the online world to increase their sales potential and their customer base. With so much of life happening in an online world these days, it’s a good idea for even the smallest business to have an online presence so that customers can find them. One way to grow your online business is to offer your customers a wide variety of payment options. This includes not only credit card transactions, but also the ability to accept checks online. Many customers today want to pay by check, and giving them the option can give you a much needed edge over the competition.