Accept Phone Checks: Simplifying Your Payment Collection Process

The Inefficiencies of Traditional Check Processing

Do you feel overwhelmed by the time and effort it takes to process each check that arrives by mail? This method not only involves numerous costs but also seems less efficient compared to other consumer payment forms. However, embracing the convenience of accept phone checks can offer you numerous benefits. Nowadays, an increasing number of companies recognize the value of adding a phone payment option. The traditional method of processing checks is time-consuming; customers write and mail the checks, and then you endorse them for deposit. Following this, you’re required to physically go to the bank to deposit the paper checks, a task that proves inconvenient for both your customers and staff. Furthermore, if your business involves providing services or collecting payments, relying on mailed checks can be unreliable. Sometimes, despite their promises, people fail to mail the checks. Conversely, phone checks facilitate real-time transaction processing. Customers provide their details during the call, which are then entered into a system, leading to next-business-day deposits. These transactions are not only secure and received more quickly, but they also enhance overall efficiency.

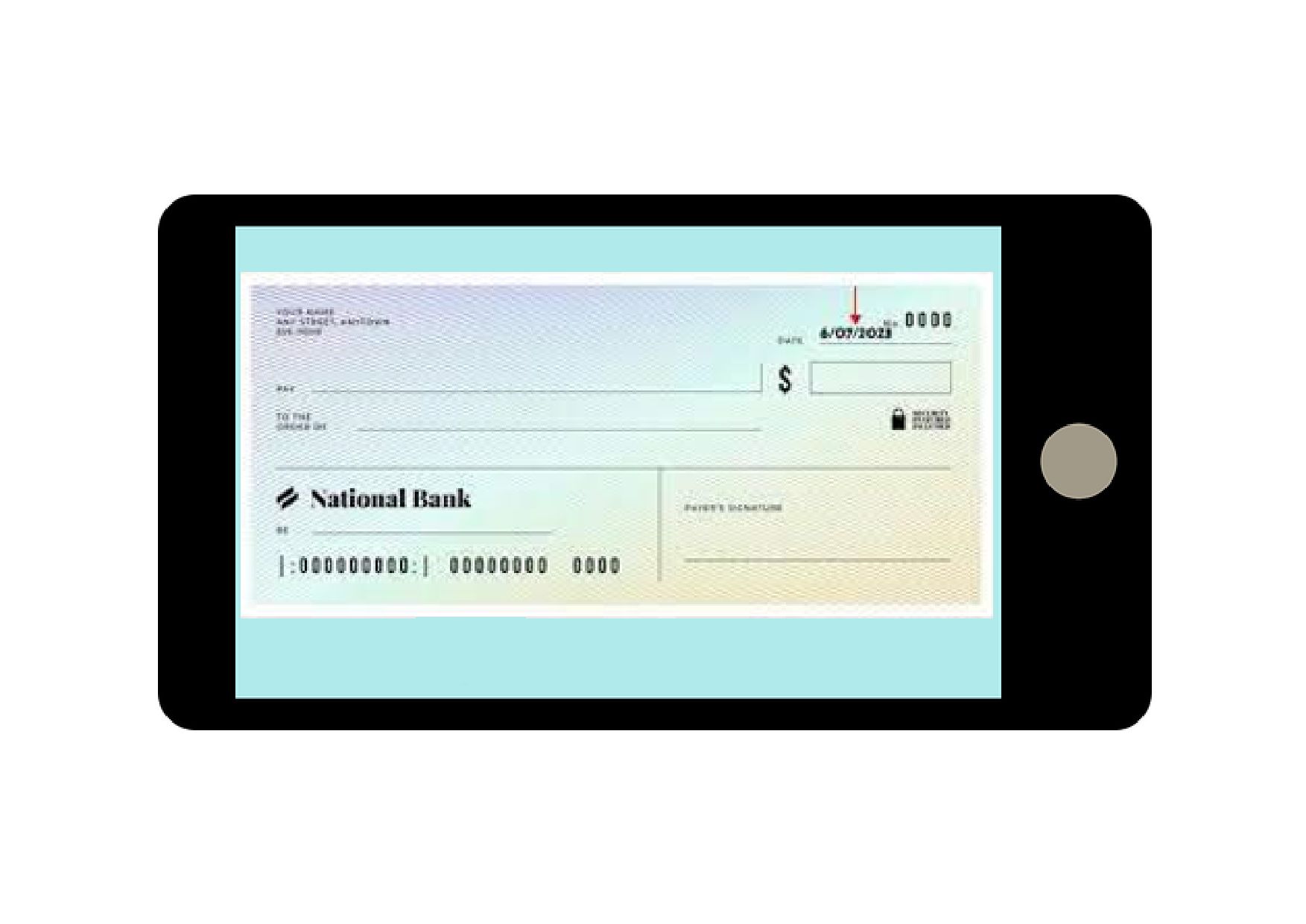

Understanding Check by Phone Transactions

Accepting payments through phone checks is both quick and straightforward. The process kicks off when a customer makes a call or a representative reaches out to secure a payment. The employee then promptly inputs the customer’s account details into a secure portal. This information includes a nine-digit routing number, the account number, and the customer’s name, address, and phone number as they appear on the check. The customer needs to provide verbal authorization to complete the transaction, after which you electronically submit it for system authorization. From there, the service provider handles the remaining tasks involved in receiving funds for each transaction, streamlining the process for efficiency.

The Perks of Accepting Checks by Phone

The ability to take check by phone payments allows you to forego the continual expense involved with processing paper checks by mail. It is just as simple to accept checks as it is to process credit transactions. With reduced costs and expedited fund deposits, you have the continual ability to monitor accounts, thereby lessening the bank fees you incur. Set up recurring customer payments to reduce staff time and make more profits. When you accept phone checks, you receive the additional benefits of less bank trips, decreased risk of fraud, and lower numbers of bad checks.

Initiating Your Journey with AVPS

Starting the process does not involve an extensive amount of work on your part. With one phone call to AVPS, we can begin by helping you select the appropriate merchant account and services. After establishing your merchant account, we’ll help you initiate the secure gateway for transaction processing seamlessly. Our staff will explain all fees to ensure you know what to expect when customers begin paying by check either by phone or the web. Services are convenient, secure, and can match the needs of your customers.